SAP S/4HANA Material Ledger: Features, Benefits, and Real Business Scenarios

In today’s competitive business environment, organizations need real-time cost transparency, accurate inventory valuation, and streamlined financial reporting to stay ahead. This is exactly where the SAP S/4HANA Material Ledger comes into play.

As a powerful tool for multi-currency valuation, profit analysis, and integrated accounting, it helps businesses gain deeper insights into their production and sales costs while ensuring compliance with global standards.

In this post, we’ll explore the key features, major benefits, and real-world business scenarios of SAP S/4HANA Material Ledger in simple, easy-to-understand language so that both finance professionals and business leaders can maximize its potential.

Note:

To get the most value from this topic, we recommend reading this full blog post and watching the embedded YouTube video below.

The post provides structured insights and practical examples, while the video offers a visual walkthrough to reinforce key concepts. Together, they deliver a complete learning experience for SAP professionals

1) Why Material Ledger Activation is mandatory in S4 HANA.

In today’s complex global business landscape, companies frequently operate across multiple countries—each governed by its own financial, tax, and legal regulations. As a result, organizations must manage parallel valuations, where the same material or inventory must be valued differently based on varying accounting principles, such as International Financial Reporting Standards (IFRS) and Local GAAP. For example, a business may use standard price valuation for IFRS while applying moving average valuation for local compliance—all for the same material.

Moreover, multi-currency valuation becomes equally essential when transactions occur in one currency, reports are generated in another, and statutory accounting is required in a third. A global enterprise might procure materials in USD, manage operations in EUR, and report in the local currency of its subsidiaries. This complexity requires a robust solution to handle real-time, accurate, and compliant multi-currency valuations.

Parallel Valuation, Multi-Currency, and Material Ledger Are Essential in today’s Global Business Operations.

The Material Ledger is the basis of actual costing. It enables material inventories to be valuated in multiple currencies and allows the use of different Valuation approaches.

Let’s understand this in simple terms.

2) How to Understand Material Ledger in SAP S/4HANA.

To understand the material ledger , we need to understand the Sub-Ledger, General Ledger (GL), Trial Balance & Balance sheet.

2.1) What is Sub-Ledger

To understand the material ledger, we need to first understand the Sub-Ledger.

--> In order to understand Sub-Ledger, we need to first Understand the Basics of SAP Financial Accounting: General Ledger, Trial Balance & Balance Sheet.

2.1.1) General Ledger (GL)

In simple terms, the General Ledger (GL) is the main financial record of a company. It keeps track of all money coming in and going out, recorded as debits and credits. This is the backbone of any company’s financial accounting system in SAP S/4HANA.

2.1.2) Trial Balance

To make sure everything adds up correctly, companies use something called a Trial Balance—which is just a report showing the closing balances of all General Ledger accounts on a specific date. If the totals match, it confirms that the books are accurate.

2.1.3) Balance Sheet

The Balance Sheet then uses this data to show the financial health of the business at that point in time—listing what the company owns (assets) and owes (liabilities).

2.2) Concept of Sub-Ledger

Once you understand these core financial concepts, the next step is to explore the Sub-Ledger, which sits just below the General Ledger.

Sub-ledgers track detailed transactions for specific areas like customers, vendors, or assets. These transactions are posted either directly or through automated journal entries from integrated modules like SAP FICO, MM, or SD.

Material Ledger/Actual Costing is a Sub-Ledger like AP, AR, Fixed Assets

3) Functionality of Material Ledger

Below are the main functionalities of material ledger.

- Inventory Valuation/revaluation

- Visibility of Price changes

- Updating Standard Cost with Actual Prices (optional)

- Periodic Unit price.

--> In simple terms, the Material Ledger in SAP S/4HANA is a tool that records all transactions related to materials—whether it's purchasing, receiving goods, price changes, or consumption during production.

--> Material Ledger keeps track of how much materials cost and how they are used, while also supporting multiple currencies and different valuation methods (like standard price or actual cost).

3.1) Actual Costing

Actual costings means inventories are valued at Actual Cost based on the Actual Costing Runs.

Here inventories are valuated at actual cost means Materials are valued at Standard Price which is then adjusted to reflect the difference between the preliminary price and cost.

In Material Master accounting tab, the value of the field “Price determination” determines the actual costing.

Since our material is having price determination as 2 (Transaction based) as shown in the above screenshot, the price difference gets posted to FI and will not participate in inventory valuation at actual cost.

--> Looking at the material as shown in the above screenshot, for our car business Material Ledger is active but actual costing is inactive

3.2) Multiple Currencies & Valuations

The Material Ledger is a powerful functionality in SAP S/4HANA that enables parallel valuation of inventory in multiple currencies and accounting principles.

--> Material Ledger allows businesses to record, manage, and report material movements and inventory values across different valuation views (legal, group, and profit center)

--> Material Ledger supports up to three currencies for each material document.

For example : In the below screenshot a material is shown to have price in three currencies

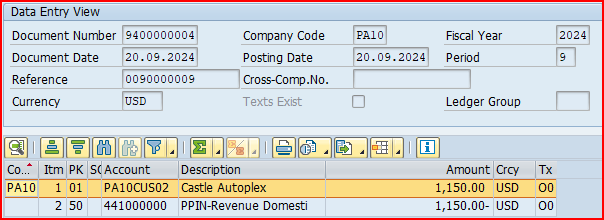

If a transaction is posted in CNY, we can see the FI document in all the three currencies.

In the below picture, it is shown how Material Ledger makes possible multiple currencies along with multiple valuations.

With Material Ledger, organizations gain real-time visibility into inventory costs, currency fluctuations, and financial impacts—ensuring transparent and compliant financial reporting across all jurisdictions.

In the below section, we present real-world business scenarios that illustrate the practical relevance of the three valuation views available in the SAP S/4HANA material master.

These views—legal, group, and profit center—enable organizations to assess material values from different financial perspectives. The Material Ledger supports up to three currencies per material document to ensure accurate valuation across multiple reporting requirements, such as local statutory compliance, group-level consolidation, and internal profitability analysis.

This multi-currency capability helps businesses maintain financial transparency and consistency across global operations

4) Real Business Scenarios

Imagine we have a multinational business which operates in Canada, Singapore & USA. This business has a company & Plant each in Singapore & America and Headquarters in Canada.

- This business sends semifinished materials from Singapore company to USA company on an intercompany price which include a small profit margin for SG company. USA company does further operation and sells the finish materials to the customers in USA.

4.1) Business Scenario 1 – Legal Valuation

This scenario involves legal reporting. Company A sells to company B in selling price of 120 Singapore Dollar with Company A cost of 100 Singapore Dollar. It means Company A profit is 20 Singapore Dollar. So business wish – while doing legal reporting in each country, system should automatically prepare the report as per the local country rules & regulation and as per the local currency. In the above example – while reporting this transaction in the USA legal reporting, system should report inventory cost in USA company as equivalent of 120 Singapore Dollar converting into US Dollar.

Statutory reporting in local currency. Required for tax and legal

compliance.

4.2) Business Scenario 2 – Group Valuation

When semi-finished goods are sent from SG to US the transaction is booked in Singapore company in the currency Singapore Dollar and simultaneously the inventory received in the US plant (including profit margin of SG company in currency SINGAPORE DOLLAR) should be converted from the Singapore Dollar to the US DOLLAR and then booked in the currency US DOLLAR.

This business has below wish

- Group valuation should be prepared automatically as per rules & regulations. For example -While doing the group valuation, the internal profit margin of 20 Singapore Dollar should be eliminated. This is to ensure that the group’s consolidated financials reflect only external profits.

- Since group headquarters is in Canada, so while doing group reporting, company is using currency CANADIAN DOLLAR. So, it is a natural wish that all the transactions happening in the different countries/between the different countries, should be converted to CANADIAN DOLLAR on a predefined mutually agreed currency conversion base.

Consolidated reporting across company codes. Eliminates internal

profits to ensures that the group’s consolidated financials reflect only external profits

4.3) Business Scenario 3 – Profit Center Valuation

This scenario involves profit centre accountings in the respective company. Company A sells to company B at a negotiated selling price of 110 Singapore Dollar with Company A cost of 100 Singapore Dollar. It means Company A Manufacturing Profit Centre books profit of 10 Singapore Dollar.

Similarly, Company “B” Sales profit center books profit of Sales Price (in US DOLLAR) to customer minus US DOLLAR equivalent of 110 SINGAPORE DOLLAR.

Internal transfer pricing and profitability analysis between business

units.

Material Ledger makes it possible with simultaneously posting of all the transactions into different currencies relevant for each valuation.

Now that you have a solid understanding of SAP S/4HANA Material Ledger—its key features, benefits, and practical business scenarios—it’s time to move forward with activation. In the next post, we will guide you through the minimal configuration required to enable Material Ledger in your S/4HANA system. Refer to the post below for a clear, step-by-step activation process in just five easy stages, along with common errors and their root causes to help you avoid potential pitfalls.

How to activate Material Ledger in S4HANA in 5 Easy Steps

The post SAP S/4HANA Material Ledger: Features, Benefits, and Real Business Scenarios appeared first on Ultimate SAP Guides | S4 HANA Logistics Modules.